|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Home Loan Interest Rate Comparison: Essential Tips and InsightsUnderstanding Home Loan Interest RatesWhen considering a home loan, the interest rate is a crucial factor. It affects your monthly payments and the total cost of your mortgage. A lower interest rate means lower monthly payments and less interest paid over the life of the loan. Factors Influencing Interest RatesCredit ScoreYour credit score is a key determinant of the interest rate you receive. Lenders use it to assess your risk as a borrower. A higher score typically means a lower interest rate. Loan Amount and TermThe amount you borrow and the term of the loan also influence the interest rate. Larger loans and longer terms may attract higher rates.

Comparing Different LendersIt's essential to shop around and compare rates from different lenders. This can save you thousands of dollars over the life of the loan. Consider using online resources to compare rates effectively. For those interested in jumbo mortgage rates california, it's crucial to understand that these rates can vary significantly based on the lender and your financial profile. Common Mistakes to Avoid

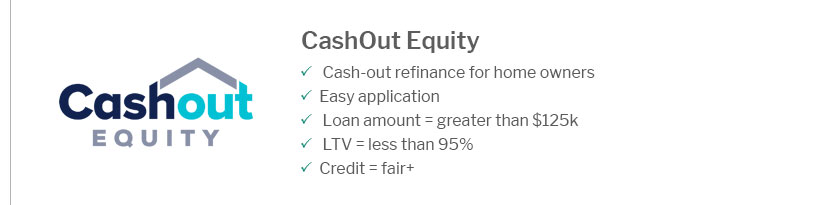

Exploring options like cash out refinance near me can provide additional benefits depending on your financial goals. Frequently Asked Questions

https://www.mortgagenewsdaily.com/mortgage-rates

Mortgage Payment w/ Amortization - Mortgage Loan Comparison - Early Mortgage Payoff. Learn About Mortgage Rates. https://www.bankrate.com/mortgages/mortgage-rates/

Experts predict rates to decline ; 6.70% - 6.36% - 5.96% - 5.82% ; 0.00% - 0.00% - 0.00% - 0.00%. https://better.com/loan-comparison-calculator

It's a good idea to improve your credit score as much as possible before shopping for a home loan. That way, you have a better shot at obtaining a lower ...

|

|---|